CLUBHOUSE PURCHASE/BUDGET RECAP & ACTIONS

- Medley's HOA budget QUADRUPLED this year -- from just under $500k to over $2 Million annually

- The budget's "Total [Operating] Expenses without Reserve" was $490,563 at end of 2024 [unadited] and now with the clubhouse purchase, the Total Operating Expenses are budgeted at $2,018,877

- That $2M operating budget excludes the $1.5M as "Reserves" that was also borrowed in the loan and is discussed below as "Reserves".

- Florida HOA statutes §720.303(6) and (7) specify HOA Budgets and Financial Reporting requirements. As a large HOA, we are in the highest tier of financial reporting requirements --audited financial statements are mandatory.

- Yet, as of December, we were still waiting for the audited financial report from 2024 that was due in April 2025. Is that how it was only just discovered that Medley has only 854 homes, not 855, as was budgeted contributing to a deficit? It's suprising that our attorney evidently did not file a complaint for the audited statements.

- The budget timeline published by Castle managers on TownSquare was not followed.

- Although two announced budget 'workshops' were held with members on October 16 and November 6, both missed Castle's published deadline of October 10, 2025 for "statutory 2026 budget mailing date to members." In fact, the budget was never mailed to members, only the meeting announcement was.

- The November 6 budget 'workshop' was when the clubhouse operating deficit was first disclosed to members in the "2025-11-04 MSS budget V9 WITH Food and Beverage.xlsx" file. (This file has since been removed from the HOA's website. ) It was the only detailed information on which members could vote at the Annual Meeting on November 11, because the updated budget was not even provided before or displayed at the meeting.

- Many members were surprised to learn of the large operating losses when it was finally disclosed.

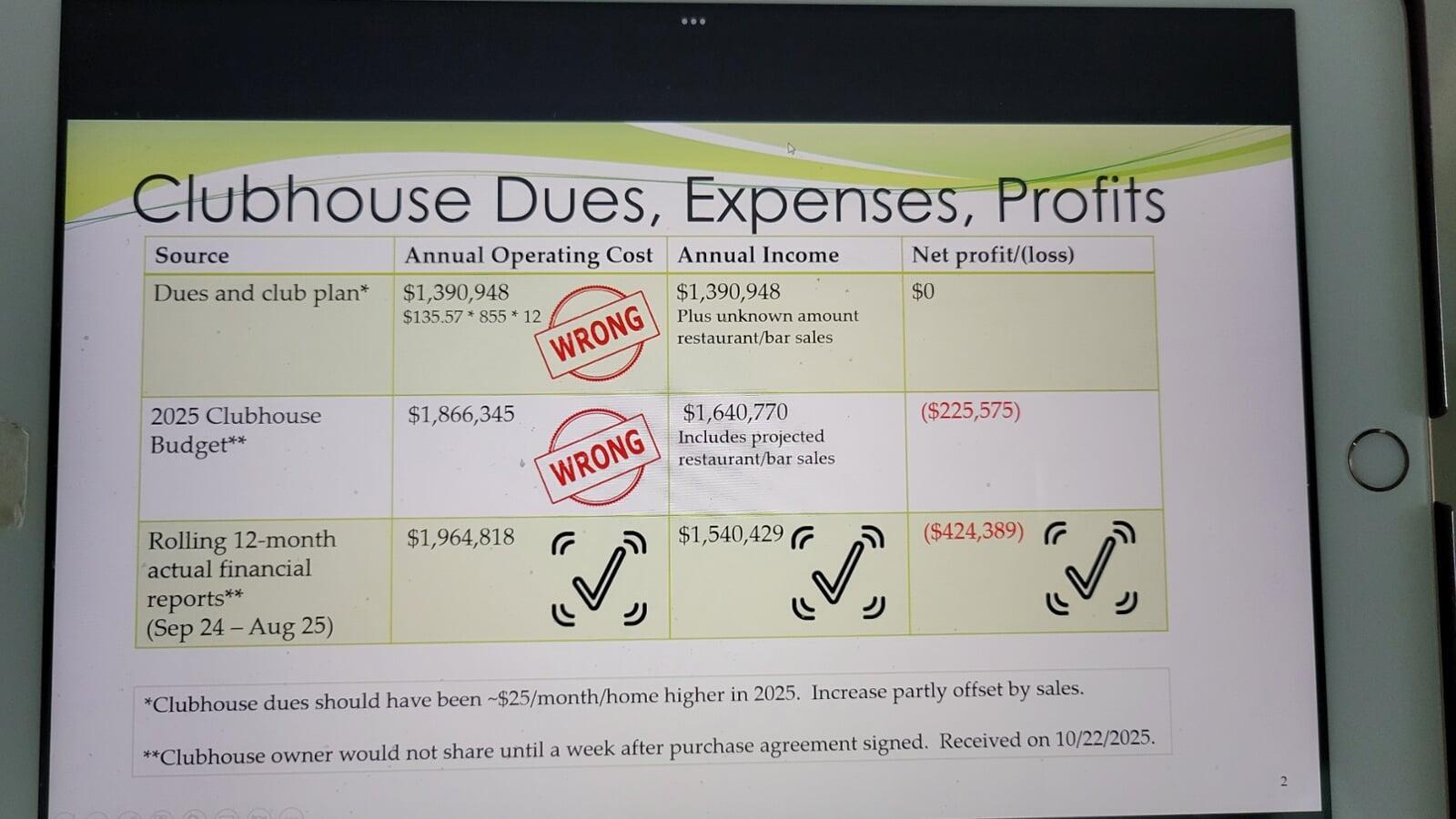

- The following slides were presented to homeowners at the August 12, 2025 Townhall by the Clubhouse Acquisitions Committee prior to the membership vote to purchase the Clubhouse at the August 27 proxy vote.

- Notice the term "Reserves" is used to categorize $1.5M included in the proposed loan amount. "Reserves" are separate from "Short-term Operating Capital" ($450k) and "Immediate Maintenance Costs" ($100k) which appear to be for short-term operating expenses. (Note: these amounts are for Clubhouse/amenities only because there were already Reserves for the rest of Medley prior to purchase.)

-

- " 'Reserves' are defined in FL HOA statutes as dedicated funds set aside in the association's budget specifically for anticipated capital expenditures and deferred maintenance on common property elements. (Examples include major repairs or replacements such as roof replacement, building painting, pavement resurfacing and other items where deferred maintenance/replacement over $10,000. ) Once established by a majority vote of the membership, they become "statutory reserves" and must follow strict rules on funding and use (similar the the Reserves that we already have funded for non-clubhouse maintenance.)

- Reserve funds must remain in segregated accounts, accrue interest that stays in the reserves and can only be used for authorized expenditures (e.g. not for operating expenses.) Members can vote annually to waive or reduce funding reserves." Refer to §720.303(6) and HOA bylaws. "

- In contrast, "non-statutory reserves" are created by the board without a membership vote have fewer restrictions.

Let's look again at the allocation of funds of the $2M+ over the Club purchase price

What is the significance of the term "Reserves" in Florida's 720 statute, AI and a literature search?

The big November reveal ....

the Clubhouse was being subsidized by its owner, losing over $400k annually !

- The reason for our financial 'surprise' is that our HOA knew so little about the Club Financials when negotiating the rushed purchase.

- We homeowners only learned of hundreds of thousands of dollars in operating losses, after the P&S was signed,at the November 6 Budget workshop. According to this slide, last year's actual $424,389 Club operating loss divided by 854 homes would be $496 per year per home!

- Is it possible that some Medley folks at least suspected Clubhouse operating losses would require additional cash/loan to maintain services?

- Think about it: Why did the proposed loan amount balloon from $9 million in March -- to $11 million in August --when the Board , Finance and Acquisition Committees reportedly first learned of the operating loss on October 22, 2025 ?

- We homeowners were informed of it on November 6 and were rushed to approve the budget less than a week later on November 11.

- Did we borrow up to $1.5M in funds --not for captial reserves -- but to cover operating expenses to simply maintain similar Club services?

- The latest budget distributed after the meeting reflects that $1.5M in Reserves as "Revenue income from Special Assessment." to balance the budget.

- Statutory financial reporting requirements are strict for captial reserves as mentioned above and this should be reviewed. Let's verify where Reserve funds were being deposited.

- Realistically, the only reason that the Medley HOA is not bleeding cash and facing an additional Special Assessment for Club operations this year is because we borrowed so much 'extra' money (with interest.)

- Insist that the HOA financials differentiate between true Capital Reserves and operating reserves to ensure each is properly reflected in 2026. Capital reserves should be locked down for its statutory purpose. (Maybe even hire a different Financial Auditor for the HOA that can count houses correctly and start over with the audited financial statements.)

- Let's request quarterly budget workshops with homeowners in 2026 to see what's working and can change.

Engage with Clubhouse operations and Event committees with our ideas and to provide oversight as we collectively learn about cafe and event costs/revenues. New committee members are being announced at the Jan. 13 HOA Board meeting per the agenda.

- Our HOA has only six months before we have an opportunity to select a different Club management company or renew this one. Let's all become informed by then to help decide what we want as a community and what we are willing to spend going forward.

- Now that we know the harsh financial truth, let's be cautious to avoid having "champagne tastes on a beer pocketbook" to be fair to our neighbors who may be part-time snowbirds or those on limited, fixed incomes.

What can homeowners do now?

Comments are Welcomed below!(It is not required to enter your email if you comment as "Guest".)